Top Tips For Getting Good Home Mortgages

Article written by-Connor EganIf you have ever wanted to buy a home, then you know the mortgage process can be lengthy and very involved. So what is the best way to approach securing your own home mortgage? This article is going to discuss many tips that you can take with you to help you find what you're looking for.

Understand your credit score and how that affects your chances for a mortgage loan. Most lenders require a certain credit level, and if you fall below, you are going to have a tougher time getting a mortgage loan with reasonable rates. A good idea is for you to try to improve your credit before you apply for mortgage loan.

Start preparing for getting a home mortgage early. Get your financial business in order. You have to assemble a savings stockpile and wrangle control over your debt. Delays can cause you to lose your chance at mortgage approval.

Regardless of how much of a loan you're pre-approved for, know how much you can afford to spend on a home. Write out click the up coming web page . Include all your known expenses and leave a little extra for unforeseeable expenses that may pop up. Do not buy a more expensive home than you can afford.

Know how much you can afford to put towards your home mortgage. Do not rely on the lender to tell you the amount you qualify for, causing you to borrow the maximum amount. Try planning your budget and leaving some room for unexpected expenses. This is usually the case when you buy a home. You can use banking calculators to determine how much you can afford on a home and provide an estimate of the monthly mortgage payments.

Don't forget to calculate closing costs when applying for a mortgage, particularly if this is your first time. Above and beyond the down payment, numerous charges exist simply for processing the loan, and many are caught off guard by this. You should anticipate paying up to four percent of the mortgage value in total closing costs.

Keep in mind that not all mortgage lending companies have the same rules for approving mortgages and don't be discouraged if you are turned down by the first one you try. Ask for an explanation of why you were denied the mortgage and fix the problem if you can. It may also be that you just need to find a different mortgage company.

Make sure you've got all of your paperwork in order before visiting your mortgage lender's office for your appointment. While logic would indicate that all you really need is proof of identification and income, they actually want to see everything pertaining to your finances going back for some time. Each lender is different, so ask in advance and be well prepared.

Draw up a budget before applying for a home loan. It is important that you know how much you can realistically spend on a mortgage payment. If you aren't paying attention to your finances, it is easy to over-estimate how much you can afford to spend. Write down your income and expenses before applying for the mortgage.

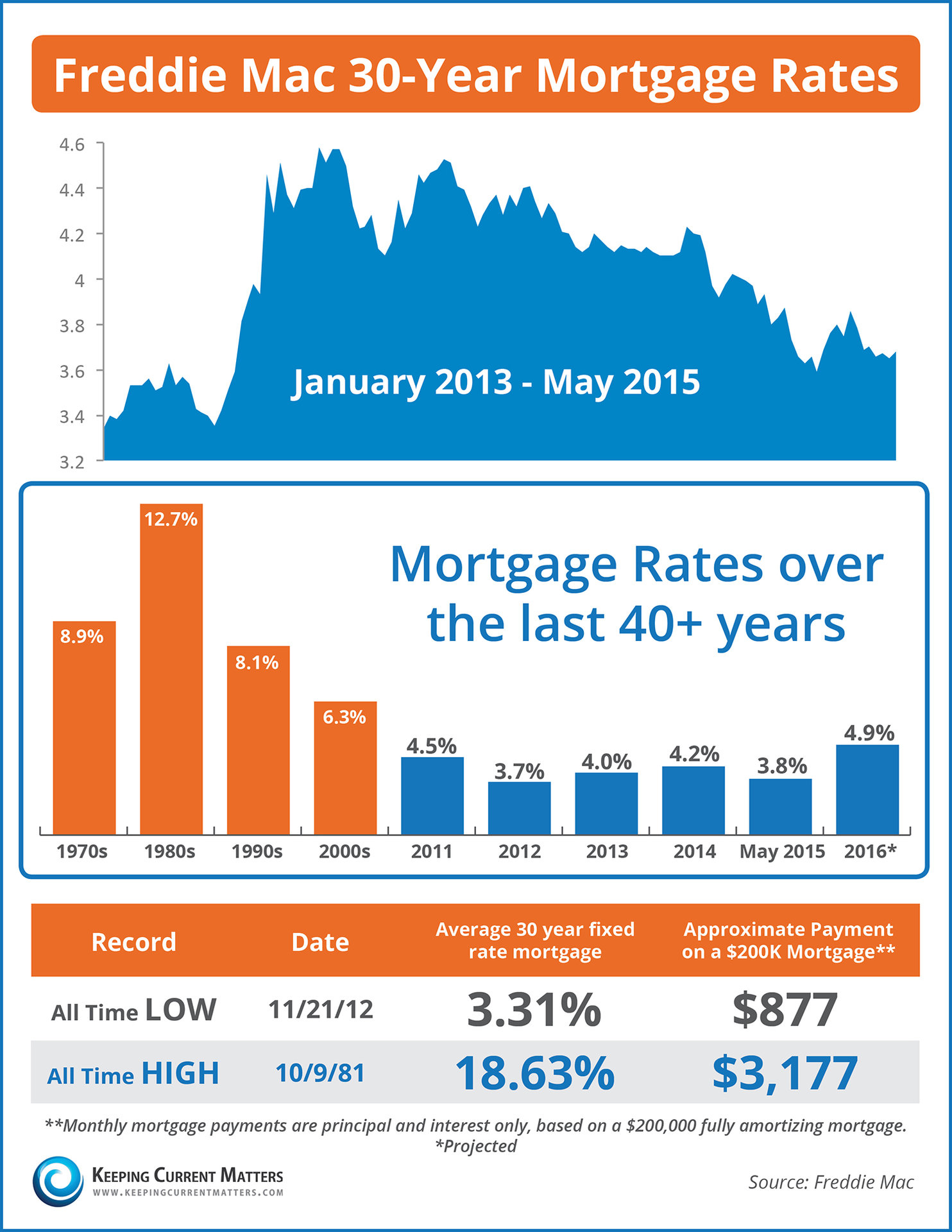

Current interest rates on home mortgages are lower than they have been in years. Experts expect them to begin increasing again shortly, so now is a great time to purchase a home and finance it at a low rate. The shorter the term of the mortgage, the better the rate you will be able to get.

Look over you real estate settlement statement before signing any papers. Your mortgage broker is required by law to show how all the monies are dispersed at the closing. If the seller has agreed to pay for some of the closing costs, ensure that this is noted on the settlement statement.

If you can afford the higher payments, go for a 15-year mortgage instead of a 30-year mortgage. In the first few years of a 30-year loan, your payment is mainly applied to the interest payments. Very little goes toward your equity. In a 15-year loan, you build up your equity much faster.

Before you begin home mortgage shopping, be prepared. Get all of your debts paid down and set some savings aside. You may benefit by seeking out credit at a lower interest rate to consolidate smaller debts. Having your financial house in order will give you some leverage to get the best rates and terms.

Get at least three mortgage offers before deciding on which one to go with. Home mortgages, like many other loans, will vary in their costs and rates from lender to lender. What you think is a good deal may not be, so it's important to see multiple options before making a decision.

Do not give up if you do not have success getting a home mortgage. Do what you have to do to change your credit score, save some more money or whatever else you have to do to get yourself in a home. Don't, however, sign up for a mortgage that you will have trouble paying.

You can save money on a mortgage by going with a lender who offers to finance with no closing costs. Closing costs are a significant part of a mortgage. To make up for that lost money, however, the lenders will make up it in some other way. Usually with a slightly higher interest rate.

You should have the proper paperwork ready in advance for a lender. Look well prepared. You'll need a copy of your pay stubs going back at least two paychecks, your last year's W-2 forms and a copy of last year's tax return. You'll also need your bank statements. Get those together before the lender asks.

Save some money before applying for a mortgage. Required down payments vary, but you probably want to have no less than 3.5% available. The higher it is, the better it may be for you. If you take a private mortgage, you'll need to pay extra if you put less than 20 percent down.

As was stated in click here for more of this article, the mortgage financing process is very complicated. It can seem indecipherable to a real estate novice. The key to financing a great mortgage that allows you to buy the home of your dreams is to educate yourself on the mortgage process. Study the mortgage tips and advice in this article very carefully.